5 Hacks to Paying Off Your Mortgage Early

HOW WOULD IT FEEL TO BE MORTGAGE FREE?

I don’t know about you, but I can think of a few things I would spend my money on if I no longer needed to pay my mortgage down! Just because you take out a 30-year mortgage, doesn’t mean you have to take the full 30 years to pay it off.

Let’s look at 5 hacks you can start incorporating today to pay your mortgage off early!

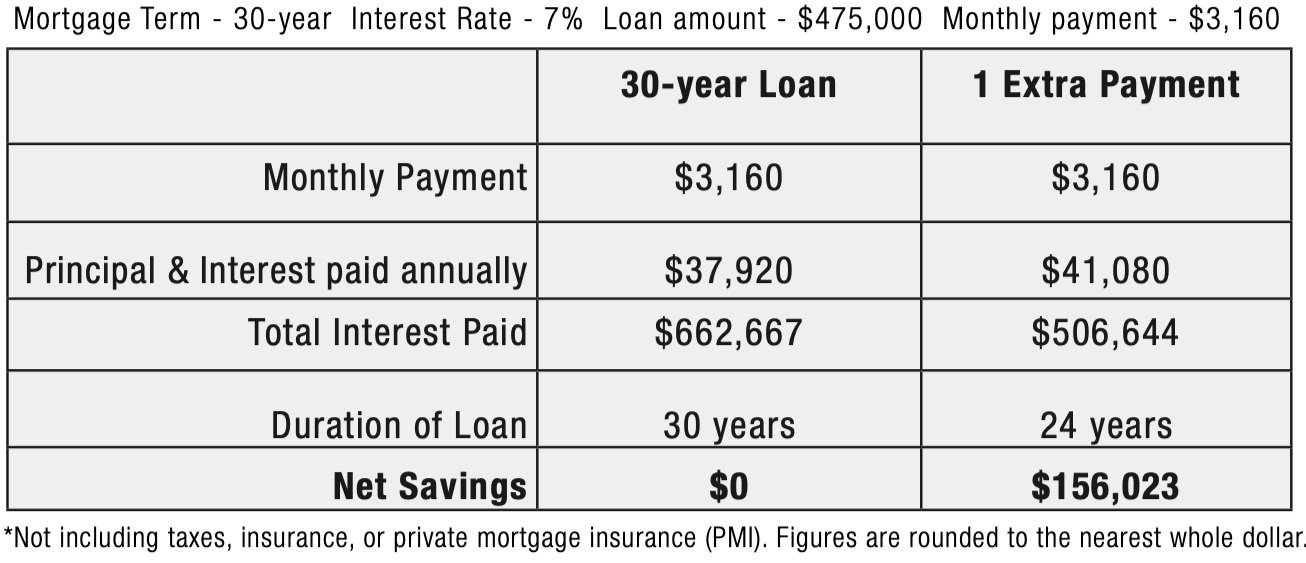

MAKE 1 EXTRA LOAN PAYMENT EACH YEAR

By making one extra payment per year, a homeowner can reduce the amount of interest they will pay over the life of the loan, for the duration of the loan. In this example, the monthly payment is $3,160. By making 1 extra monthly payment each year of $3,160, a 30 year mortgage will be paid off six years ahead of schedule, and net over $156,000 in savings.

Tip: By making the extra payment in January, you are hacking the total number of days the mortgage is collected on.

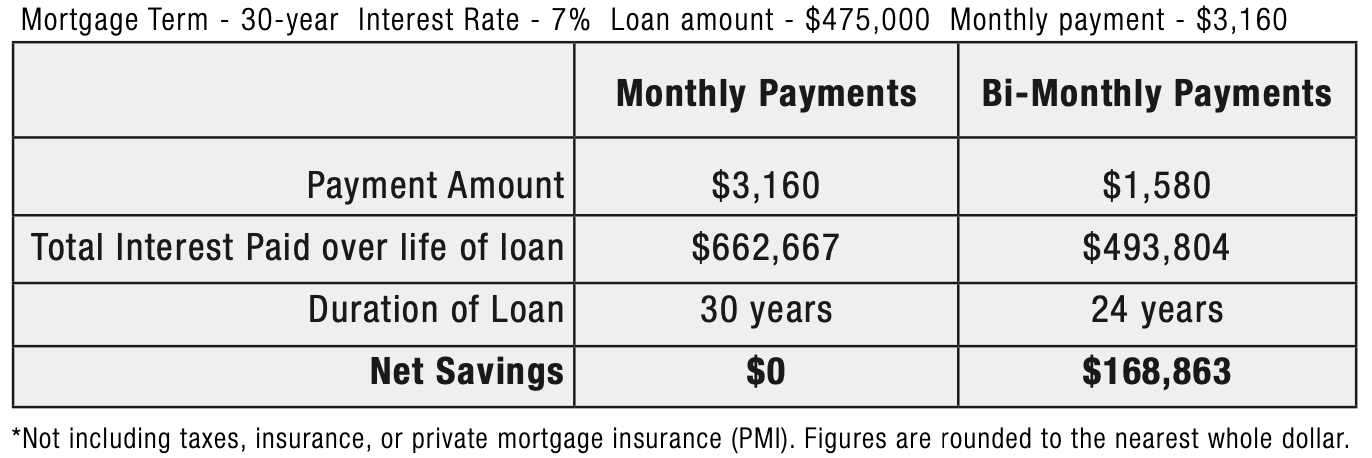

PAY BI-WEEKLY INSTEAD OF MONTHLY

By paying monthly, the borrower pays a total of $3,160 per month. With a bi-weekly plan, they will pay $1,580 every two weeks. By switching to bi-weekly payments, the borrower will shorten the repayment period to just 24 years vs 30 years. The net savings would be $168,863 and six years off the mortgage!

ROUND UP THE PAYMENT

By increasing the monthly payment to a round number, a borrower can save money on the interest paid over the life of the loan and shorten the duration of the term of the loan. The precise amount of money and time saved will depend on the amount of rounding.

By rounding up a monthly payment of $3,160 to $3,200 every month, $32,483 will be saved in interest and the duration of the loan will decrease by roughly 2 years.

DOLLAR-A-MONTH PLAN

Each month, increase the payment by on dollar - starting with $900 the first month, $901 the second month, and so on. This could reduce the term of the mortgage by eight years.

USE “SURPRISE MONEY” OR BONUSES TO MAKE EXTRA PAYMENTS

Use unexpected money to help pay down your loan. This is one of the easiest ways to pay down debt, including a mortgage more quickly. More than likely this money is not accounted for in a monthly or yearly budget, so it’s easier to use in this scenario.

THE BOTTOM LINE

The real key is to combine tips to supercharge your efforts and pay off your mortgage in half the time! The more money you can put towards your monthly mortgage payment, the quicker you will pay it off.

It will take time though. A mortgage balance is a large amount of money, and you can’t pay it off overnight. But don’t let this deter you. It can a smart financial decision to save on interest payments, and free up cash down the road. Keep your eye on the prize.

Imagine when the day comes, to no longers have a mortgage payment and how drastic your monthly budget would shift. Any extra amount you can pay each month, not only shaves off the time you have left to pay down your mortgage balance, but also saves you money in interest charges along the way. And that interest savings adds up!

Note - You should discuss a strategic approach with your Financial Advisor if you have one. As of recent, many individuals refinanced their home loans to drop the interest rate. If your home loan is around a 3% interest rate, you could benefit from taking any excess cash and investing it elsewhere vs. paying down your mortgage quicker. Be sure to discuss it with your financial team and see what works best to align with your long term goals.

You’ve got this!

Jen

The Landlord Starter Kit provides essential platforms, templates, and strategies to establish strong rental property operations. From comprehensive lease agreement details and move-in/move-out checklists to an order of operations and rental application forms, this kit equips new and experienced landlords with practical resources to manage their rental properties efficiently.